Making meaning of financial data derived from cash flow statements, balance sheets, ratios, income statements, and statements of shareholders’ equity is called financial analysis.

Although there are many different kinds of financial analysis, these three techniques are the most popular:

- Horizontal analysis, also known as “trend analysis,” assesses changes across time by comparing financial records from one period to the next. It entails figuring out whether or not the numbers have changed, and if so, why.

- Vertical analysis is a method of analyzing a financial document’s single column to ascertain how several figures interact over the course of a given reporting period.

- Ratio analysis examines the connection between various financial data points in the same report.

To analyze a company’s finances and make wise decisions, managers need to have the ability to conduct financial analysis.

Reading Financial Statements

Effective leaders should be able to read and comprehend basic financial documentation. The balance sheet, income statement, and statement of cash flows are the three that are most crucial.

• Assets, liabilities, and equity are listed on balance sheets, which also convey a company’s value for a certain reporting period. This information can be used by managers to comprehend the financial situation of their company.

•Income statements commonly referred to as “profit and loss (P&L) statements,” list a company’s revenues and outgoings to show how it performed within a specific time frame.

• Cash flow statements track a company’s cash movements during a certain accounting period. They aid in managers’ comprehension of the company’s ability to operate both in the short- and long-terms given the cash flow.

Reading and Interpreting Financial Statements with respect to the Laboratory

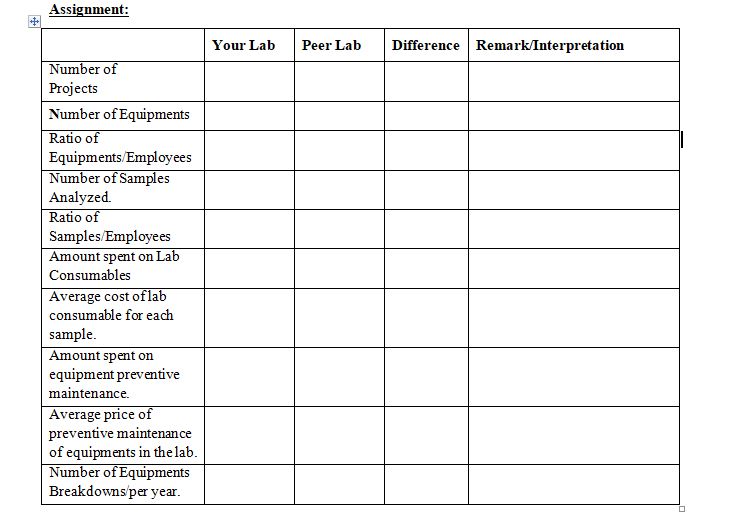

As a lab manager reading Cash flow statements, profit and loss (P&L) statements/Assets, liabilities and equity might not be directly related to your lab, but as a intelligent manager you should be able to interpret them in terms of laboratory inputs/outputs and finally draw your conclusions. (Refer: Assignment)

Understanding Numbers

Because everyone interprets numbers differently, numbers only supply information and do not provide meaningful comprehension. Additionally, businesses in various industries have various priorities.

To find meaning in your numbers, you must:

Understand your business in order to interpret your figures. What objectives has your organization set? What stock do you have? Sometimes the value of inventory decreases rapidly.

Evaluate your performance against that of rivals in your sector. Every industry doesn’t use the same ratios.

Beyond Just Numbers

Although necessary, statistics don’t provide the full picture. The most priceless firm assets, including one of the following:

Brand: One of a company’s most important assets is its brand, yet it isn’t listed on a balance sheet.